- Business with Beers

- Posts

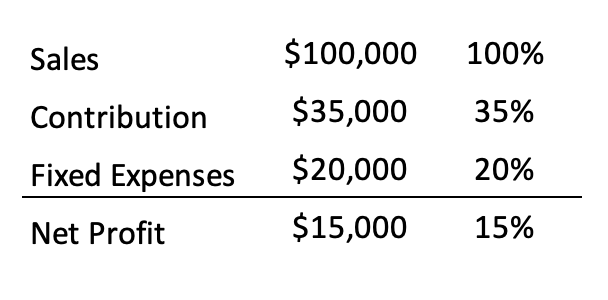

- A Simple Franchise P&L

A Simple Franchise P&L

These 4 lines is all you need

People with fancy MBA's like to create complicated financial models.

As a simpleton, I like to break down a P&L into 4 numbers.

Sales

Contribution

Fixed Expenses

Net Profit

This model works for your first location, 5 locations, or even 30+ locations.

Sales

My dad always says "Sales fix everything."

There's a lot of truth to that statement. Sales are your lifeblood. You can't save your way to wealth. You need to increase sales through more marketing, locations, higher prices & better customer service.

Increasing sales dilutes your fixed costs.

For example, let’s say rent is $5k per month.

At $50k sales rent expense is 10% sales ($5k / $50k)

At $100k sales rent is 5% of sales

At $200k rent is 2.5% of sales

The more you increase sales, the more you dilute your fixed expenses, which increases your net profit.

Contribution

Contribution is the profit that's left over after paying all variable expenses. Variable expenses are directly tied to your sales When sales go up, variable expenses go up. When sales go down, variable expenses go down.

Franchises have five major variable expenses:

COGS - cost of goods sold

Royalty - paid weekly or monthly

Advertising - local & national spend

Direct Payroll - cost of performing the service

Credit Card Fees - cost per transaction

Contribution is the amount left over after paying all the variable expenses

Let's say we've got 65% of variable expenses, leaving us a 35% contribution margin. That 35% margin is sticky no matter the sales volume.

Cost of goods (COGS) and payroll are the two biggest expenses you can influence as a franchisee. Royalties, credit card fees, and all fixed expenses are what they are.

From my example above, if we can reduce COGS from 25% to 23% and payroll from 27% to 25% we’d increase the contribution margin by 4% (2% COGS + 2% payroll)

Assuming your fixed costs are covered, if you are doing $1M per year in sales you just increased net profit by $40,000. If you are doing sales of $10M per year, you just increased net profit by $400,000!

While 2% changes here and there may sound small, they greatly impact your bottom line.

Fixed Expenses

These are your overhead expenses that are consistent every month. They have a minimal correlation to sales volume.

Rent & Utilities

Debt Payments

Managers & Admin Payroll

Insurance, Software, & Other Misc. Expenses

Picture your fixed expenses as a bucket. The contribution profit pours into the fixed costs bucket.

The first $5k of contribution profit goes to pay your rent, $2k for the debt payment, $10k for payroll, $3k for insurance, technology & the remaining expenses.

No net profit exists until you fill-up the bucket. The magic happens once the bucket is filled and all the incremental contribution profit overflows & becomes net profit.

Small increases in sales lead to much larger increases in your net profit. In my example below:

+20% sales = +47% net profit

+50% sales = +117% net profit

Try It Out

Step 1: Take your P&L and categorize all expenses as variable or fixed.

Variable - it goes up and down with sales. COGS, payroll, cc fees, advertising & royalties

Fixed - everything else that doesn't go up & down with sales

Step 2: play around with your numbers. See what happens when:

You increase sales

Increase contribution margin (by lowing COGS/Payroll %)

Reduce fixed expenses

The magic happens when you can do all 3!

Let's Connect

I have a team that helps people get into franchising. We provide personalized franchise matching based on your budget, goals, skills & location, and it costs you nothing to work with us. Get started today by booking a call!

On my podcast, Business with Beers, I interview franchisors, franchisees, & do deep dives into specific topics.

Cheers!

Brian Beers